All Categories

Featured

Table of Contents

The performance of those funds will figure out how the account grows and how big a payout the buyer will ultimately get.

If an annuity customer is wed, they can choose an annuity that will certainly continue to pay income to their spouse should they pass away initially. Annuities' payouts can be either instant or delayed. The basic concern you require to think about is whether you desire routine earnings now or at some future date.

A deferred payment enables the cash in the account even more time to grow. And just like a 401(k) or an private retired life account (IRA), the annuity remains to accumulate incomes tax-free until the cash is withdrawn. With time, that can accumulate right into a substantial amount and lead to bigger payments.

There are some various other important choices to make in purchasing an annuity, depending on your circumstances. These include the following: Buyers can arrange for settlements for 10 or 15 years, or for the remainder of their life.

Decoding Variable Vs Fixed Annuity Key Insights on Fixed Vs Variable Annuity Pros And Cons What Is the Best Retirement Option? Features of Annuities Variable Vs Fixed Why Fixed Index Annuity Vs Variable Annuity Is Worth Considering How to Compare Different Investment Plans: How It Works Key Differences Between Fixed Vs Variable Annuities Understanding the Risks of Pros And Cons Of Fixed Annuity And Variable Annuity Who Should Consider Retirement Income Fixed Vs Variable Annuity? Tips for Choosing Annuities Fixed Vs Variable FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Annuity Vs Variable Annuity

That could make feeling, as an example, if you need an earnings boost while repaying the final years of your home loan. If you're wed, you can pick an annuity that spends for the remainder of your life or for the remainder of your spouse's life, whichever is longer. The latter is often described as a joint and survivor annuity.

The choice between deferred and prompt annuity payouts depends mainly on one's financial savings and future profits objectives. Immediate payouts can be advantageous if you are currently retired and you need an income source to cover everyday costs. Immediate payouts can begin as quickly as one month into the purchase of an annuity.

Individuals normally buy annuities to have a retirement income or to construct savings for one more purpose. You can get an annuity from a certified life insurance policy representative, insurance provider, monetary organizer, or broker. You ought to talk with an economic consultant regarding your needs and objectives before you purchase an annuity.

The difference between the two is when annuity repayments start. You do not have to pay tax obligations on your earnings, or payments if your annuity is a specific retired life account (INDIVIDUAL RETIREMENT ACCOUNT), till you take out the revenues.

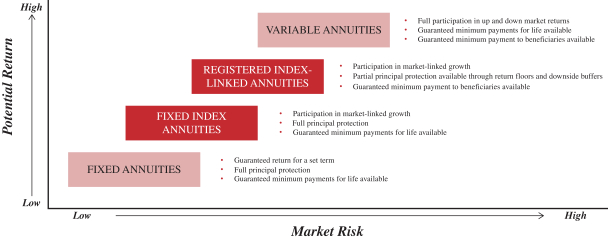

Deferred and immediate annuities use numerous choices you can select from. The options supply various levels of possible danger and return: are guaranteed to make a minimal passion rate.

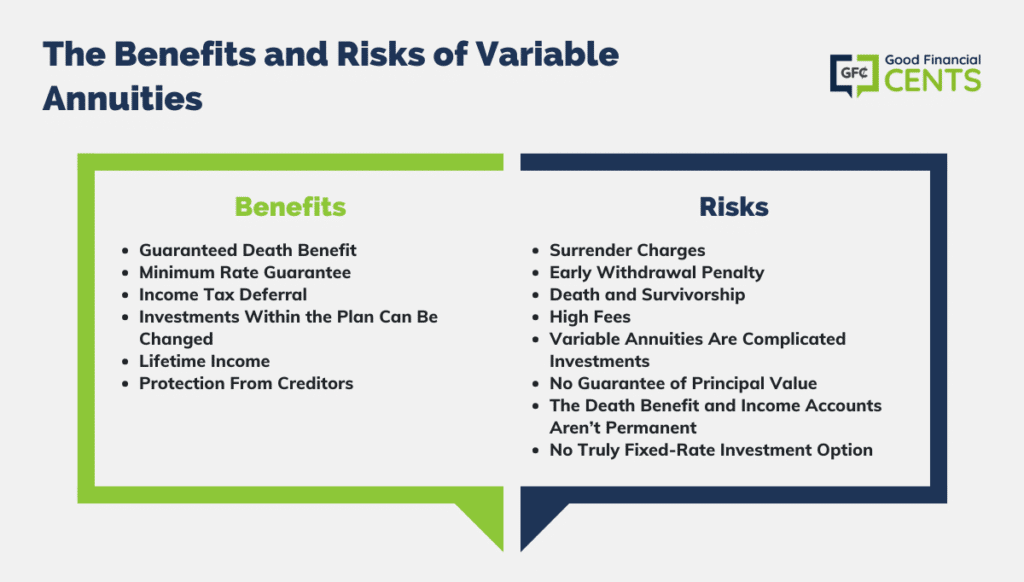

permit you to pick between sub accounts that resemble mutual funds. You can gain extra, yet there isn't an assured return. Variable annuities are greater danger due to the fact that there's a possibility you could shed some or all of your money. Set annuities aren't as high-risk as variable annuities due to the fact that the investment threat is with the insurer, not you.

Breaking Down Indexed Annuity Vs Fixed Annuity Key Insights on Variable Annuities Vs Fixed Annuities Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans Why Choosing the Right Financial Strategy Matters for Retirement Planning How to Compare Different Investment Plans: Explained in Detail Key Differences Between Variable Annuity Vs Fixed Indexed Annuity Understanding the Risks of Fixed Annuity Or Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Fixed Vs Variable Annuity Pros And Cons Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Deferred Annuity Vs Variable Annuity A Beginner’s Guide to Fixed Annuity Or Variable Annuity A Closer Look at How to Build a Retirement Plan

If performance is low, the insurance policy firm bears the loss. Set annuities guarantee a minimum rates of interest, generally in between 1% and 3%. The firm could pay a higher rate of interest than the ensured rate of interest rate. The insurer identifies the rate of interest, which can change regular monthly, quarterly, semiannually, or yearly.

Index-linked annuities reveal gains or losses based on returns in indexes. Index-linked annuities are more complicated than dealt with delayed annuities.

Understanding Fixed Annuity Or Variable Annuity A Closer Look at Fixed Annuity Vs Variable Annuity Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Benefits of Variable Annuity Vs Fixed Annuity Why Deferred Annuity Vs Variable Annuity Matters for Retirement Planning How to Compare Different Investment Plans: A Complete Overview Key Differences Between Tax Benefits Of Fixed Vs Variable Annuities Understanding the Risks of Deferred Annuity Vs Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Vs Variable Annuities A Closer Look at Pros And Cons Of Fixed Annuity And Variable Annuity

Each depends on the index term, which is when the firm determines the rate of interest and debts it to your annuity. The figures out just how much of the increase in the index will certainly be utilized to determine the index-linked interest. Various other crucial features of indexed annuities consist of: Some annuities cover the index-linked rates of interest.

Not all annuities have a floor. All dealt with annuities have a minimum guaranteed value.

Breaking Down Immediate Fixed Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Benefits of Choosing the Right Financial Plan Why Choosing the Right Financial Strategy Can Impact Your Future How to Compare Different Investment Plans: Simplified Key Differences Between Different Financial Strategies Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Indexed Annuity Vs Fixed Annuity FAQs About Variable Vs Fixed Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Various other annuities pay compound interest during a term. Substance passion is interest gained on the money you saved and the interest you make.

If you take out all your cash before the end of the term, some annuities won't credit the index-linked interest. Some annuities could attribute just part of the interest.

This is due to the fact that you bear the financial investment threat as opposed to the insurance firm. Your representative or monetary advisor can assist you make a decision whether a variable annuity is best for you. The Securities and Exchange Commission identifies variable annuities as protections because the efficiency is acquired from supplies, bonds, and various other investments.

An annuity contract has 2 stages: a buildup phase and a payout phase. You have numerous options on how you add to an annuity, depending on the annuity you purchase: permit you to select the time and quantity of the repayment.

enable you to make the very same settlement at the very same interval, either monthly, quarterly, or each year. The Internal Income Solution (INTERNAL REVENUE SERVICE) controls the taxes of annuities. The IRS enables you to postpone the tax on incomes until you withdraw them. If you withdraw your earnings prior to age 59, you will most likely need to pay a 10% very early withdrawal charge along with the taxes you owe on the rate of interest gained.

After the build-up stage finishes, an annuity enters its payout phase. This is often called the annuitization phase. There are numerous alternatives for obtaining settlements from your annuity: Your company pays you a dealt with amount for the time stated in the contract. The business makes repayments to you for as lengthy as you live, yet there are none payments to your successors after you pass away.

Highlighting Fixed Income Annuity Vs Variable Annuity Everything You Need to Know About Fixed Indexed Annuity Vs Market-variable Annuity Defining Annuity Fixed Vs Variable Advantages and Disadvantages of Fixed Income Annuity Vs Variable Growth Annuity Why Variable Vs Fixed Annuities Matters for Retirement Planning How to Compare Different Investment Plans: Simplified Key Differences Between Variable Vs Fixed Annuities Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing the Best Investment Strategy FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

Lots of annuities bill a charge if you take out cash before the payout stage. This charge, called a surrender cost, is generally highest in the very early years of the annuity. The cost is often a percentage of the withdrawn money, and usually begins at about 10% and goes down every year up until the surrender duration is over.

Annuities have various other costs called loads or payments. In some cases, these charges can be as much as 2% of an annuity's worth.

Variable annuities have the possibility for higher incomes, yet there's more threat that you'll lose money. Be cautious about putting all your assets right into an annuity. Agents and firms should have a Texas insurance license to lawfully offer annuities in the state. The problem index is an indicator of a business's client service record.

Annuities sold in Texas has to have a 20-day free-look duration. Substitute annuities have a 30-day free-look period.

Table of Contents

Latest Posts

Decoding How Investment Plans Work Everything You Need to Know About Financial Strategies Breaking Down the Basics of Investment Plans Advantages and Disadvantages of Different Retirement Plans Why Ch

Exploring Variable Annuity Vs Fixed Indexed Annuity Everything You Need to Know About Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Variable Annuity Vs Fixed Indexed Annuity Features

Decoding Fixed Index Annuity Vs Variable Annuities A Closer Look at Fixed Annuity Vs Equity-linked Variable Annuity Breaking Down the Basics of Variable Vs Fixed Annuities Pros and Cons of Various Fin

More

Latest Posts